Tax season often feels overwhelming, even for seasoned professionals. Between deadlines, complex forms, and ever-changing regulations, the process can quickly become stressful. Fortunately, technology and innovation have made it easier to manage. With the right tools, accountants, business owners, and freelancers can save time, reduce errors, and even find some peace of mind.

Here are five powerful solutions that can transform tax filing from a dreaded chore into a manageable task.

Cloud-Based Accounting Platforms That Keep Records Organized

Organization is key when preparing taxes, and cloud-based accounting platforms have become indispensable. These systems allow users to track income, expenses, and invoices in real time. Because they are cloud-based, records are accessible from anywhere, which is especially helpful for professionals working remotely or managing multiple businesses.

Many platforms also offer built-in reporting tools that generate financial summaries tailored for tax preparation. This reduces the time spent gathering documents and ensures accuracy. For small businesses and freelancers, cloud accounting platforms provide a clear picture of financial health while simplifying the transition into tax season.

Advanced Tax Software That Simplifies Complex Filing

One of the most important tools during tax season is reliable tax software. These platforms are designed to handle everything from basic returns to complex business filings. They guide users step by step, ensuring compliance with current regulations while reducing the risk of costly mistakes.

Many tax software solutions now integrate with accounting systems, making it easier to import financial data directly. This eliminates manual entry and speeds up the process. For professionals managing multiple clients, advanced features like automated calculations, error checks, and secure cloud storage provide both efficiency and peace of mind. Choosing the right tax software can make the difference between a stressful filing season and a smooth one.

Secure Document Management Systems That Protect Sensitive Data

Tax filing involves handling sensitive information, from Social Security numbers to financial statements. A secure document management system ensures that this data is stored safely and shared only with authorized parties. These systems often include encryption, multi-factor authentication, and audit trails to track access.

Beyond security, they also improve efficiency by organizing files in a central location. Instead of searching through emails or paper folders, professionals can quickly locate the documents they need. For accountants managing multiple clients, document management systems streamline collaboration and reduce the risk of misplaced or lost files.

Automated Expense Tracking Tools That Reduce Manual Work

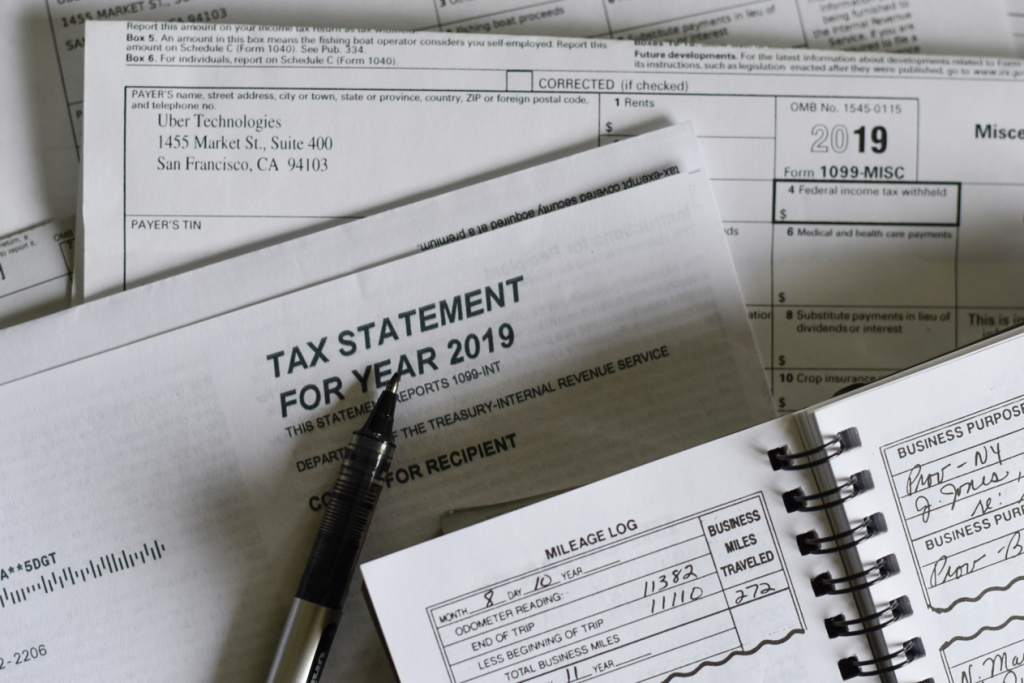

Tracking expenses is one of the most time-consuming parts of tax preparation. Automated expense tracking tools simplify this process by linking directly to bank accounts and credit cards. Transactions are categorized automatically, and many platforms allow users to upload receipts for verification. This reduces manual entry and ensures that deductions are not overlooked.

For freelancers and small businesses, these tools are especially valuable because they provide a clear record of deductible expenses throughout the year. By the time tax season arrives, much of the work is already done. Automated expense tracking not only saves time but also increases accuracy, which is critical for compliance.

E-Signature Solutions That Speed Up Client Approvals

In today’s fast-paced environment, waiting for physical signatures can delay filings. E-signature solutions eliminate this problem by allowing documents to be signed electronically in a secure and legally binding way. These tools are widely accepted by government agencies and financial institutions, making them a practical choice for tax professionals.

They also improve client communication, as documents can be reviewed and signed from any device. For accountants managing multiple deadlines, e-signature solutions ensure that approvals are obtained quickly, reducing bottlenecks and keeping the process moving smoothly.

Conclusion

Tax season does not have to be overwhelming. With the right tools, professionals and businesses can streamline their workflows, protect sensitive data, and reduce stress. From advanced tax software to secure e-signature solutions, each tool plays a role in making the process more efficient and manageable.

By embracing innovation, accountants, business owners, and freelancers can approach tax filing with confidence and focus on what matters most—building financial success for the year ahead.